The Truth About Athletes' Taxes

And what they mean for California's sports teams

In July, Le'Veon Bell's agent said that only "something exceptional" would prevent Bell, the three-time All-Pro running back for the Pittsburgh Steelers, from playing in the first week of the season. It is now Week 5 and Bell has not reported for any games.

League insiders speculated that the "exceptional" event fueling Bell's strike is his desire to land a lucrative long-term guarantee similar to the contract Todd Gurley, another standout running back in the National Football League, signed with the Los Angeles Rams.

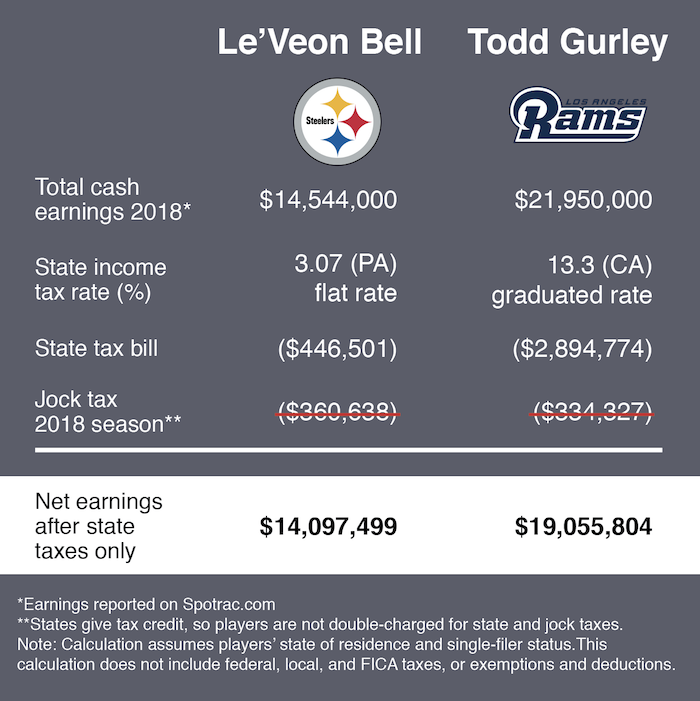

But the difference between Bell's original $14.5 million franchise tag and Gurley's four-year $57.5 million contract is not as bad as it seems when comparing the players' net earnings for the season, since Gurley will pay roughly $2.9 million in state income taxes to California.

The difference illustrates the effect of income taxes on professional athletes' salaries, which is particularly significant in California. The state has the highest income tax rate in the country for residents in the top tax bracket, at 13.3 percent. But while taxes impact athletes' income statements, the effect on players' contract decisions and the spread after factoring in all other taxes is often overstated.

"For most [athletes], when they are accepting a job, they are not making that decision based on the tax burden," said Eric Allen, an accounting professor at the University of Southern California. "The first-order condition is do I want the job? The second one is, well, is anybody even offering it to me? And then there are things like the overall cost of living, which, for most people, ends up dominating the state income tax effect."

A recent study found a negative relationship between NFL team performance and the personal income tax rates in teams' home states. According to the study, a team from California wins 2.75 games less per year than a team in a no-tax state. The study also suggests that the high tax rates are a negotiating disadvantage for teams and hinder their ability to attract quality players.

Allen, who has worked as a business manager for entertainers and athletes, is researching the effect of state income taxes on NBA player migration, and cautions against overstating the overall tax impact on a player's salary.

"The actual state tax difference of total tax burden these guys face is not the difference between the California rate and the Florida rate," Allen said. "Even if you live in Florida, you still have to pay taxes in all the states that you play in, so the difference is not, say, 13 percent."

His comment refers to the taxes professional athletes pay when competing in other states, which is often referred to as a jock tax. Athletes, entertainers and employees who earn revenue in states other than where they claim permanent residence are also taxed in those states. Professional athletes are particularly susceptible to these taxes since their playing schedules and salaries are publicaly available.

Although certain states began enforcing the jock tax as early as the 1960s, it garnered national attention in the 90s, when the Los Angeles Lakers lost to the Chicago Bulls in the 1991 NBA Finals. The Lakers hosted the Bulls for three of the five championship games, and California subsequently required Michael Jordan and his teammates to pay a portion of the revenue they earned to the state.

The legend goes that, in response, Illinois created its own law that taxed visiting professional athletes whose home states required the tax on out-of-state players. This tax became known as "Michael Jordan's Revenge."

The history of the jock tax and California's own tax law history is closely linked. Not only is California the state with the highest income tax rate, but it also hosts the most men's major league sports teams. Therefore, it is safe to assume that California collects the most revenue in income taxes from residential and visiting players compared to other states.

Sports Illustrated reported that in 2015, California collected $58 million from NFL players that did not play for the Raiders, 49ers or Chargers. In 2016, the state collected $137,000 from Carolina Panthers quarterback Cam Newton just for that year's Super Bowl, according to Sports Illustrated.

Taxes on visiting athletes provide a substantial revenue stream for states, which also collect marginal amounts on the earnings of sports personnel that travels with a team, including coaches, trainers and staff.

Seth Burton works in the communications department for the Los Angeles Football Club and travels with the team for games. He said that, similar to the players he works with, job opportunities for those in his position are limited, and job availability usually outweighs tax considerations when it comes to career moves.

"If you make that decision that you want to work in professional sports, you kind of have to go where the jobs are," Burton said.

Allen also stressed the limited opportunities for professional players. He said that the effect on athletes' contract decisions is often overstated because players have less mobility in their careers than what is typically assumed.

"What will happen is a team will have a specific need. There are maybe two or three people they think might fill that need, and he may or may not be in a high-tax state," Allen said. "If you're trying to argue that the tax is driving that decision, you're sort of ignoring that dynamic completely."

Besides the limited availability of offers, the desire to be close to family is another factor that outweighs financial considerations for many athletes.

"I've had players take a lot less money to be closer to home in places that they're comfortable," said Joe Barkett, a sports agent at Empire Athletes who works with professional football and baseball players.

Greg Kling, a Certified Public Accountant who teaches at USC, has similarly observed the influence of taxes on career decisions while working with his entertainment clients. He said that athletes consider taxes, but family is often a greater priority.

"Absolutely, professional athletes will consider [taxes]," Kling said. "Now, if they have children and want to put them in certain schools or they want to be near their families, then they live wherever they live."

There are numerous challenges researchers face when it comes to quantifying the overarching tax effect on athletes' salaries and career decisions. Each state regulates its own rates, and tax laws are constantly changing. Furthermore, many cities also have a "wage tax" that applies to athletes depending on the location of the stadium or arena in which they play. When considering a contract offer, players will consider the availability of other offers, the overall cost of living and personal living preferences far above tax implications.

We cannot expect Le'Veon Bell will appear this Sunday to gain the marginal tax benefits he receives in Pennsylvania any more than we would expect LeBron James to return to the Heat to save on his state income taxes.

As income tax rates continue to rise in California, however, the state could see a greater impact on the movement of regular residents instead of the millionaire athletes it hosts.